tax loss harvesting limit

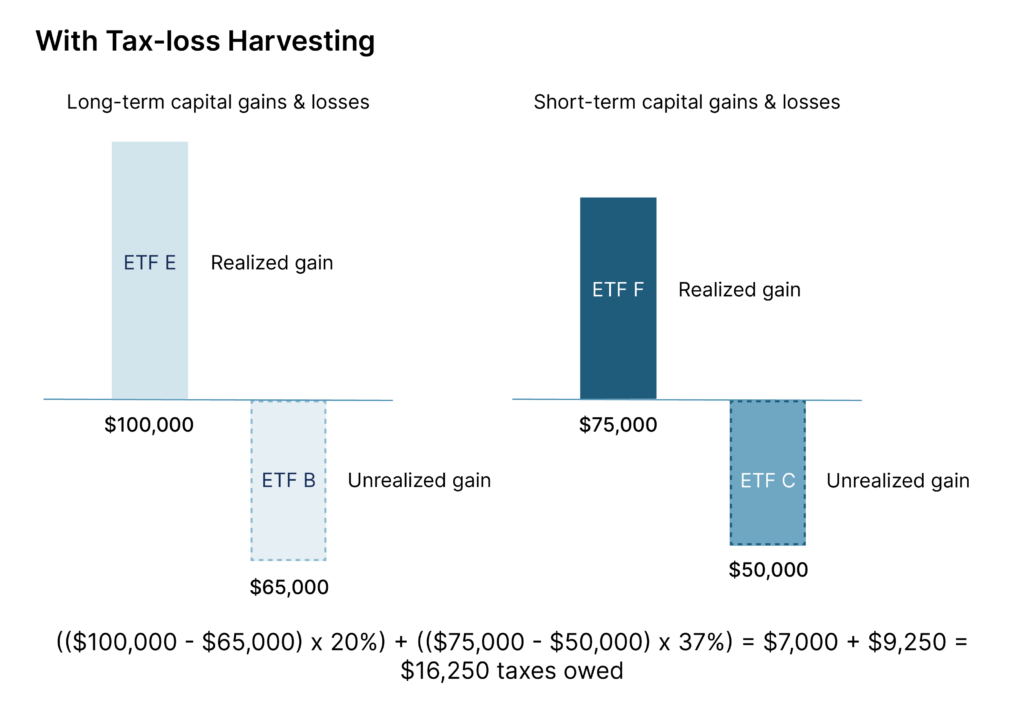

You can only do tax-loss harvesting in your taxable brokerage accountsnot in 401ks or IRAs. Tax Liability 450000 20 100000 37 Tax Liability 127000.

Tax Loss Harvesting Definition Rules Examples Seeking Alpha

Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses.

. This means that the. Suppose you bought 2 Bitcoins for 5000 and 5 Ethereum for 9000 in 2019. Tax Loss Carryforward.

Tax-loss harvesting limit. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct. There are some rules to keep in mind.

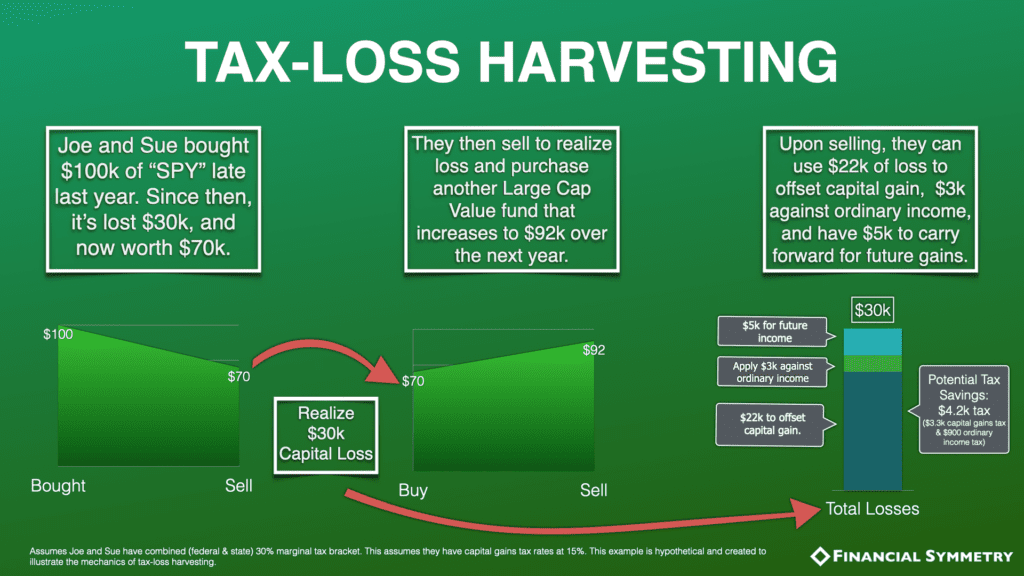

By harvesting that loss she can now offset those 2000 in gains with it so her short. The upside of losing is limited to 1500 to 3000 a year. Tax loss harvesting is a strategy that can help you potentially reduce your capital gains tax liability if you sell an asset for profit such as property or a business.

Online Assist add-on gets you on-demand tax help. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. Investors are allowed to claim only a limited amount of.

You have to use short-term losses to. A tax loss carryforward is a tax policy that allows an investor to use realized capital losses to offset the taxation of capital gains in future years. Currently the amount of excess losses you can claim as a.

To max out your taxable loss youll need to find investments where youve lost at least 9000. Before the end of the year she notices another position with an unrealized loss of 1500. Two years later you sell the 2 BTC for 8000.

Because you lost 5000 more than you gained 25000 20000 you can reduce your ordinary income by 3000 potentially lowering your tax liability an additional. If the investor wants to reduce the tax liability he can use tax loss harvesting by selling Fund Y and Z and can offset. Example of a Crypto Tax Loss Harvesting Scenario.

Look at your brokerage statements and see which investments are showing a loss.

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

What Is Tax Loss Harvesting Russell Investments

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Methodology

What Is Tax Loss Harvesting Ticker Tape

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Crypto Tax Loss Harvesting Investor S Guide Koinly

Tax Loss Harvesting And Wash Sale Rules

Tax Loss Harvesting Opportunity For Fiscal Year Fy 2021 22 Z Connect By Zerodha Z Connect By Zerodha

When Not To Use Tax Loss Harvesting During Market Downturns

What Is Tax Loss Harvesting Russell Investments

Tax Loss Harvesting Made Simple With Ycharts Ycharts

Tax Loss Harvesting A Silver Lining In Bear Markets Financial Symmetry Inc

When Not To Use Tax Loss Harvesting During Market Downturns

How To Deduct Stock Losses From Your Taxes Bankrate

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger